Unleash Your Wanderlust With HSBC’s Travel Plan: Your Path To Adventure Begins Now!

Travel Plan HSBC: Your Ultimate Guide to Hassle-Free Travels

Introduction

Welcome, readers! Are you planning your dream vacation? Look no further as HSBC presents its exceptional travel plan. With HSBC’s extensive network and comprehensive coverage, you can now explore the world worry-free. In this article, we will delve into the details of the travel plan HSBC offers, ensuring you have all the information you need to make an informed decision for your upcoming adventures.

2 Picture Gallery: Unleash Your Wanderlust With HSBC’s Travel Plan: Your Path To Adventure Begins Now!

Let’s dive right into the exciting world of the travel plan HSBC has crafted with your needs in mind.

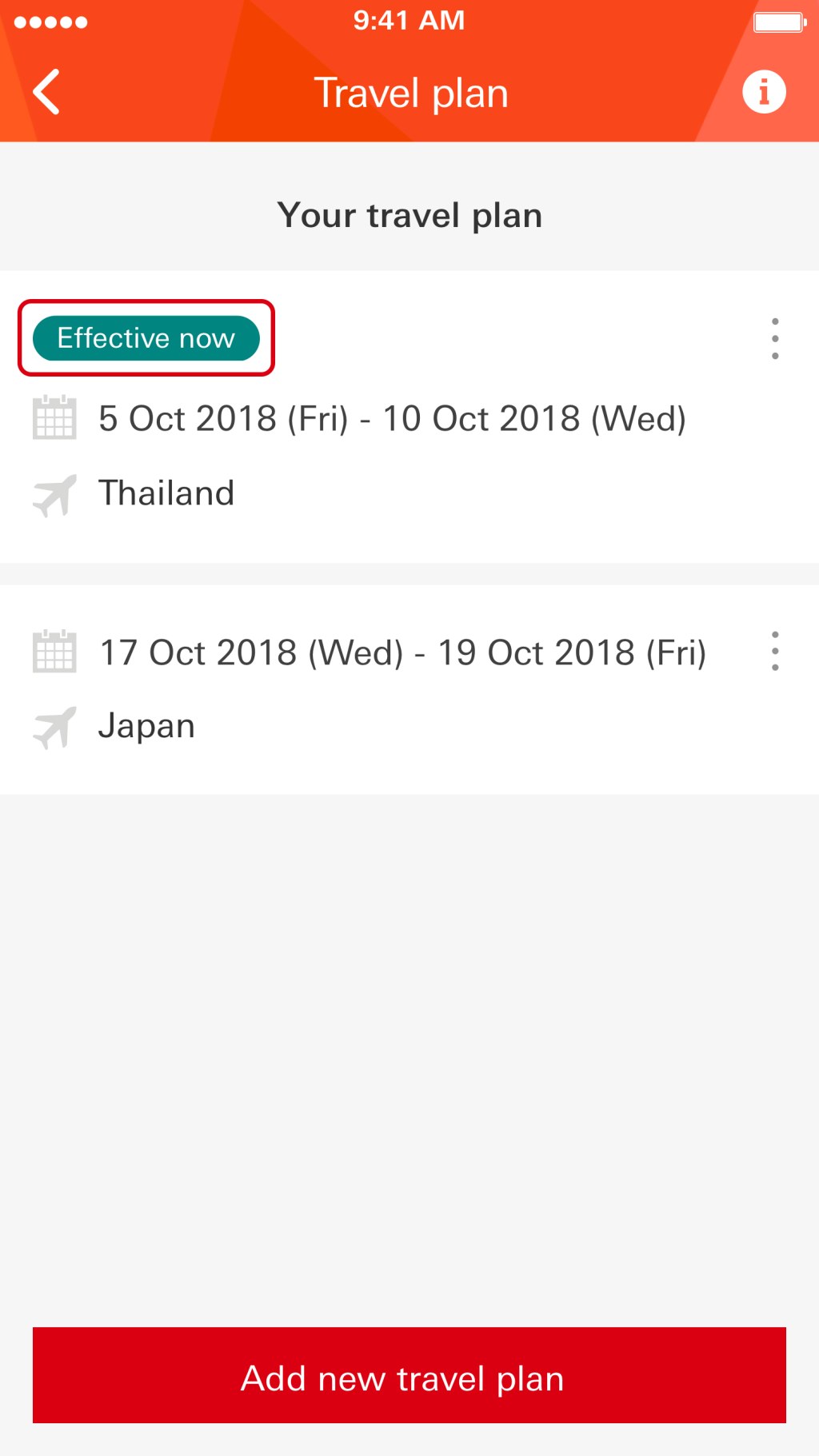

Image Source: hsbc.com.hk

But first, let’s take a look at some essential details:

Travel Plan HSBC

Insurance Coverage

Worldwide

Emergency Assistance

24/7

Medical Expenses

Up to $1,000,000

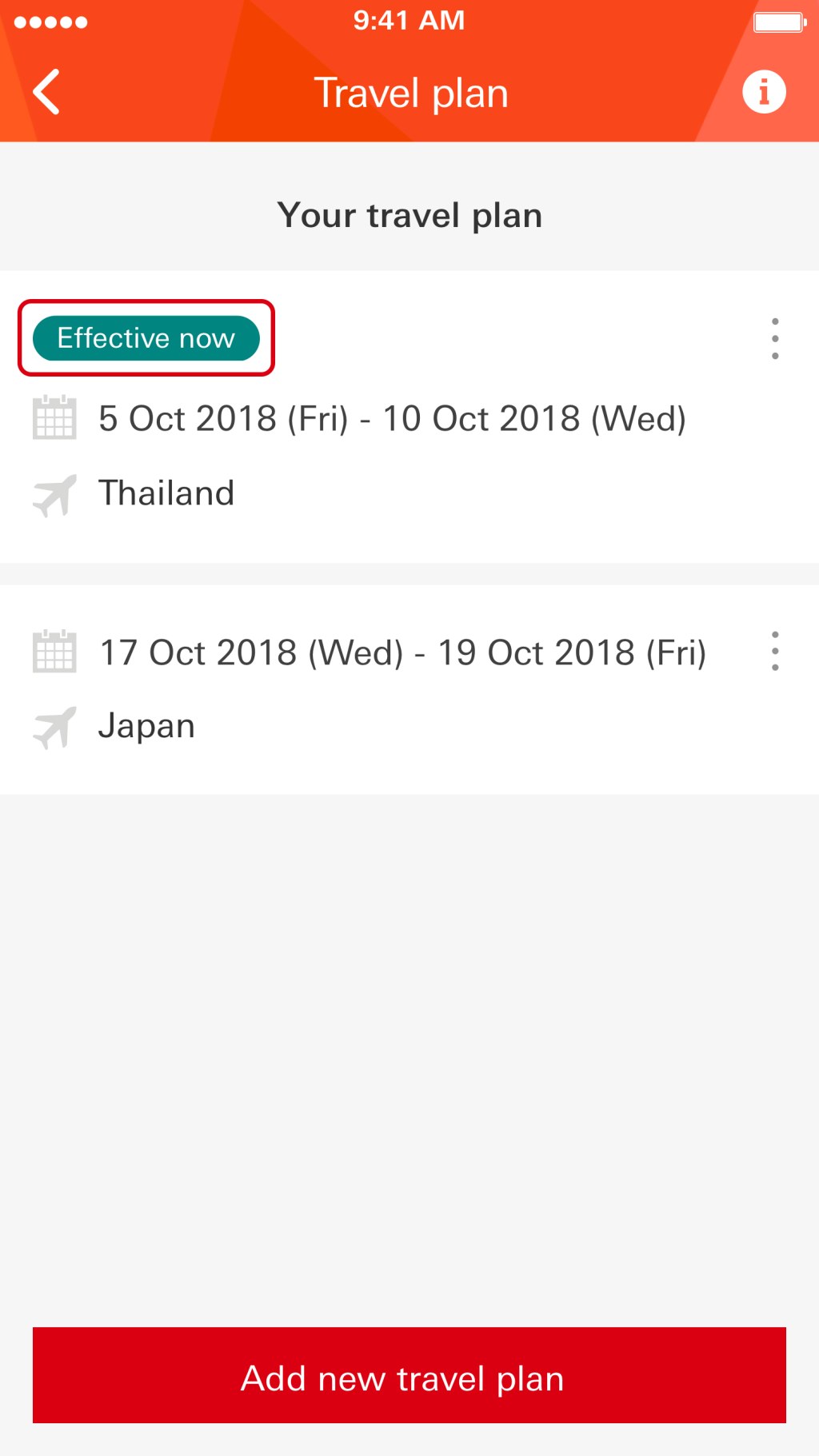

Image Source: hsbc.com.hk

Trip Cancellation

Up to $10,000

Baggage Loss

Up to $5,000

What is Travel Plan HSBC?

🌍 Travel Plan HSBC is a comprehensive travel insurance package provided by HSBC Bank, designed to protect you during your trips around the world. Whether you’re planning a quick weekend getaway or a month-long adventure, this plan offers extensive coverage for various travel-related risks and emergencies.

Who Can Benefit from Travel Plan HSBC?

🙋♂️ Travel Plan HSBC is tailored to meet the needs of all travelers, whether you’re an occasional wanderer or a frequent globetrotter. It caters to individuals, families, and even business travelers, ensuring their safety and peace of mind throughout their journeys.

When Should You Consider Travel Plan HSBC?

📅 Travel Plan HSBC should be considered whenever you embark on a journey, be it domestic or international. Accidents and unexpected incidents can happen at any time, and having travel insurance can save you from financial burdens and provide much-needed assistance during emergencies.

Where Does Travel Plan HSBC Cover?

🗺️ Travel Plan HSBC offers worldwide coverage, ensuring you’re protected regardless of your travel destination. Whether you’re exploring the bustling streets of Tokyo or relaxing on the pristine beaches of Bali, this plan has got you covered.

Why Choose Travel Plan HSBC?

❓ Travel Plan HSBC stands out from other travel insurance options due to its extensive coverage and exceptional benefits. Here are some compelling reasons to choose this plan:

Comprehensive Medical Expenses Coverage

🏥 In the unfortunate event of an illness or injury during your trip, HSBC’s travel plan covers medical expenses up to $1,000,000, ensuring you receive the necessary care without worrying about hefty bills.

Trip Cancellation Protection

🛫 If unforeseen circumstances force you to cancel or postpone your trip, HSBC’s travel plan offers coverage of up to $10,000. This protection ensures you don’t bear the financial burden of non-refundable expenses.

Lost Baggage Reimbursement

🛄 Traveling with valuables? HSBC’s travel plan provides coverage for lost or stolen baggage up to $5,000, allowing you to travel with peace of mind knowing that your belongings are protected.

24/7 Emergency Assistance

🆘 HSBC understands that emergencies can occur at any time. That’s why their travel plan includes round-the-clock emergency assistance services. Whether you need medical advice or require immediate assistance, help is just a phone call away.

Easy Claim Process

💼 HSBC has simplified the claim process to ensure a hassle-free experience for their customers. With a dedicated claims team and a straightforward online system, you can submit your claims quickly and conveniently.

What Are the Pros and Cons of Travel Plan HSBC?

✅ Every product has its advantages and disadvantages. Let’s take a closer look at what makes the travel plan HSBC a top choice for travelers:

Advantages:

1. Extensive worldwide coverage for various travel-related risks.

2. High medical expense coverage for peace of mind.

3. Flexibility to choose the duration of coverage based on your travel plans.

4. Quick and hassle-free claim process.

5. Additional benefits such as trip cancellation and baggage loss coverage.

Disadvantages:

1. Premium rates may be higher compared to other travel insurance options.

2. Some pre-existing medical conditions may not be covered.

3. Coverage limitations for specific activities or extreme sports.

Frequently Asked Questions about Travel Plan HSBC

1. Is travel plan HSBC valid for domestic travel?

Yes, HSBC’s travel plan covers both domestic and international travel, providing you with comprehensive protection wherever you go.

2. Can I purchase travel plan HSBC if I have pre-existing medical conditions?

HSBC’s travel plan provides coverage for pre-existing medical conditions; however, certain conditions may have specific terms and limitations. It’s advisable to review the policy terms or consult with an HSBC representative to understand the coverage details.

3. Can I extend the coverage period of my travel plan HSBC?

Yes, you can extend the coverage period of your travel plan HSBC. Simply contact HSBC’s customer service or visit their website to update your coverage dates.

4. Does travel plan HSBC provide coverage for trip cancellation due to COVID-19?

HSBC’s travel plan covers trip cancellation due to unforeseen events, including COVID-19-related circumstances. However, coverage may vary, so it’s advisable to review the policy terms or consult with an HSBC representative for detailed information.

5. How do I file a claim with travel plan HSBC?

Filing a claim with HSBC’s travel plan is easy. Visit their website or contact their dedicated claims team to initiate the process. Make sure to provide all necessary documentation and details to ensure a smooth claim settlement.

Conclusion

In conclusion, HSBC’s travel plan is an excellent choice for anyone seeking comprehensive coverage and peace of mind during their travels. With worldwide protection, extensive medical expenses coverage, and 24/7 emergency assistance, you can explore the world worry-free.

Don’t let unexpected incidents ruin your travel experiences – choose travel plan HSBC and embark on your next adventure with confidence!

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only. The coverage, terms, and conditions of travel plan HSBC may vary depending on your location and individual circumstances. It is crucial to review the policy terms and consult with an HSBC representative to understand the specific details of the plan before making a purchase decision.

This post topic: Travel Planning